Form 1099-G: Comprehensive Overview of Government Payments

Oct 04, 2024 By Elva Flynn

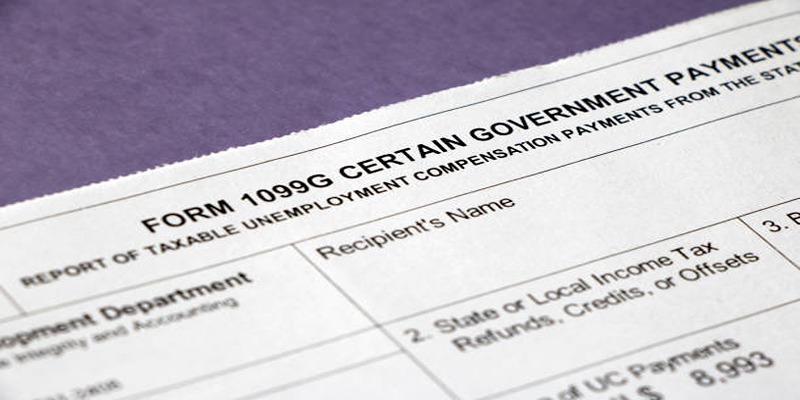

Form 1099-G is a crucial document for taxpayers who have received certain types of government payments over the course of the year. This form reports distributions from government agencies that may have an impact on your federal tax return. Commonly reported payments include unemployment compensation, state or local income tax refunds, agricultural payments, and taxable grants. Understanding Form 1099-G is essential for accurate tax filing, as it ensures that all taxable income is reported correctly. This overview will guide you through the key components of Form 1099-G, helping you comprehend its purpose, the types of payments it covers, and the implications for your tax responsibilities. Stay informed to avoid any potential issues with your tax filings.

What is Form 1099-G?

Form 1099-G, also known as the "Certain Government Payments" form, is an information return used to report specific types of payments made by federal, state, and local government agencies. These payments are considered taxable income and must be reported on your federal tax return. The form includes important details such as the amount received and any taxes withheld, which can impact your tax liability for the year.

Types of Reported Payments

Some common types of payments reported on Form 1099-G include:

- Unemployment compensation: If you received unemployment benefits during the year, these will be reported in Box 1.

- State or local income tax refunds: If you received a refund on your state or local income taxes, this amount will be reported in Box 2.

- Agricultural payments: Payments received under an agricultural program administered by the Commodity Credit Corporation are reported in Box 3.

- Taxable grants: Certain types of government grants may be considered taxable income and will be reported in Box 4. Examples include disaster relief payments and housing assistance.

Who Receives Form 1099-G?

Form 1099-G is issued to individuals and entities that have received certain types of government payments, which are potentially subject to federal taxation. These recipients typically include those who have collected unemployment compensation, received a state or local income tax refund, benefited from agricultural support payments, or obtained taxable government grants. In essence, if you have received any payment from a federal, state, or local government agency that falls under these categories, you will likely receive a Form 1099-G.

Its important to note that each government agency responsible for making these payments is required to furnish the form to both the recipient and the Internal Revenue Service (IRS), ensuring that the reported income is accurately reflected in your tax filings.

How to Read Form 1099-G

Reading Form 1099-G correctly is vital for accurate tax reporting and ensuring you meet your tax obligations. Here is a breakdown of the key boxes and information included in the form:

- Box 1 Unemployment Compensation: This box lists the total amount of unemployment benefits you received during the tax year. This amount must be reported as income on your federal tax return.

- Box 2 State or Local Income Tax Refunds: If you received a refund, credit, or offset of state or local income taxes of $10 or more, the total amount will be shown in this box. This amount may need to be reported as income on your federal return, depending on whether you itemized your deductions in the previous year.

- Box 3 Box Reserved: This box was previously used for agricultural payments, but as of recent IRS updates, it is now reserved for future use.

- Box 4 Federal Income Tax Withheld: If any federal income tax was withheld from your payments, the amount withheld will be listed here. You can use this amount as a credit against your total federal tax liability when filing your return.

- Box 5 RTAA Payments: This box is used for reporting all Reemployment Trade Adjustment Assistance (RTAA) payments.

- Box 6 Taxable Grants: Any government grants you received that are considered taxable income will be listed in this box. Examples include disaster relief payments and housing assistance, which must be reported on your tax return.

- Box 7 Agriculture Payments: If you received any payments under an agricultural program, such as those administered by the Commodity Credit Corporation, the total amount will be shown here.

- Box 8 Trade or Business Income (Repaid amounts): This box is used to report any trade or business income that you repaid, which was previously reported as income.

- Box 9 Market Gain: This box reports market gains associated with loan repayments for agricultural commodities.

Review each box carefully and ensure that the amounts match your records for the year. Accurate reporting of the information in each box is essential for correct tax filing and avoiding any discrepancies with the IRS.

Tax Implications and Reporting

Understanding the tax implications of the payments reported on Form 1099-G is crucial for accurate tax filing. Each type of payment reported on the form can impact your tax liability in different ways:

- Unemployment Compensation: The total amount of unemployment benefits reported in Box 1 is considered taxable income by the IRS. It must be included in your gross income on your federal tax return. Depending on your total income and filing status, this could affect your tax bracket and the amount of tax you owe.

- State or Local Income Tax Refunds: Amounts reported in Box 2 may or may not be taxable, depending on whether you itemized your deductions in the previous tax year. If you claimed a deduction for state and local taxes paid, you may need to include the refund as income on your federal return. However, if you took the standard deduction, the refund is generally not taxable.

- Agricultural Payments: Payments reported in Box 7 are considered taxable income and must be reported on your tax return. These payments can come from various programs, including those administered by the Commodity Credit Corporation.

- Taxable Grants: Taxable grants reported in Box 6 include certain types of government assistance, such as disaster relief payments and housing assistance. These amounts are considered taxable income and should be included on your federal tax return.

- Federal Income Tax Withheld: Any amount listed in Box 4 represents federal income tax that was withheld from your payments. You can use this amount as a credit against your total federal tax liability when filing your return.

It's essential to accurately report all amounts listed on Form 1099-G to avoid discrepancies with the IRS. Misreporting or omitting information can lead to penalties, interest, or an audit.

Conclusion

Form 1099-G plays a vital role in your tax reporting process, documenting various types of government payments that may affect your federal tax liability. Understanding how to read and correctly report the information on this form ensures compliance with IRS requirements and helps avoid potential issues such as penalties or audits. By diligently reviewing each box, recognizing the tax implications of the reported amounts, and including the necessary details on your tax return, you can confidently navigate the complexities of your tax obligations. Accurate and thorough reporting not only aligns you with legal requirements but also provides peace of mind as you manage your financial responsibilities.

-

Mortgages Feb 24, 2024

Mortgages Feb 24, 2024What Is a No-Income Loan? What You Need To Know

No-income loans are loans made for people who don't have a steady source of income, like a full-time job. Most of the time, these loans require you to have enough cash on hand or other ways to make money to pay back the loan, and the lender is required to check these sources.

-

Investment Nov 11, 2023

Investment Nov 11, 2023Auto Manufacturers' Raw Materials

The automotive industry uses various raw materials from all over the globe to make automobiles and parts. Rubber, steel, plastics, and aluminum are among automobiles' most widely used materials.

-

Know-how Dec 03, 2023

Know-how Dec 03, 2023Buy Now, Pay Later – Everything that You Need to Know

If you are also curious to know what BNPL is and how it works, then this article is everything that you need.

-

Know-how Jan 31, 2024

Know-how Jan 31, 2024Deciphering Plaid: A Comprehensive Guide to Its Functionality

Plaid Cash app is a fintech platform that facilitates secure data connections between financial institutions and apps, streamlining transactions. Click to read more.